EBOOK: THE HIGH COST OF LENDING UNCOVERED

Unlock the massive small-ticket lending and leasing market

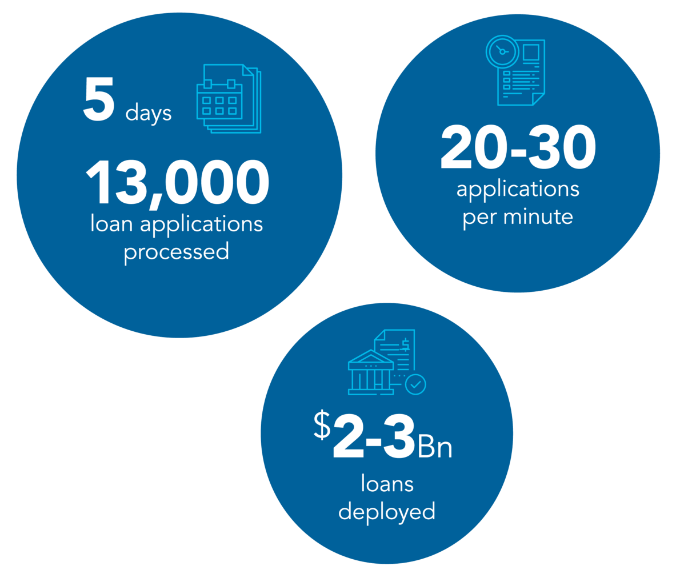

Small-ticket lending and leasing is often fiddly and slow, with low margins—but this doesn’t have to be the case. Q2 Lending’s Straight-Through Processing (STP) makes it quick, easy and lucrative. Download our eBook to learn more.