- 5 years of service

- $6.1B+ in assets

Growing and serving with intention

In the mid-1990s in Grand Rapids, Michigan, a group of entrepreneurial-minded bankers envisioned a new way of banking that put the customer at the center of everything they did. And in 1997, Mercantile Bank was formed. Serving consumers and businesses of all sizes, they’ve become the largest community bank headquartered in Michigan today. But even as they’ve grown and evolved, they’ve remained committed to customer service and community focus. Because for Mercantile, growth isn’t the only goal—it’s the byproduct of keeping their customers at the forefront of every move they make.

Why Mercantile Bank banks on Q2

To easily integrate the solutions their customers need

With their extensible digital banking platform, Mercantile can seamlessly integrate new solutions to address their customers’ evolving needs—from advanced chat support to sophisticated payments functionality. In fact, Mercantile’s live chat feature attracted over 20,000 users in 18 months. And not only have they seen drastic adoption from consumer account holders, but also business customers whose busy schedules demand quick interactions. Putting real bankers right at their customers’ fingertips is just one example of how Mercantile uses digital to reduce barriers and deliver next-level support.

To serve increasingly sophisticated businesses

Mercantile’s modern digital solutions help them serve larger, more complex commercial customers. They protect their assets with tools like Positive Pay—preventing $5 million in fraud for one customer within just 30 days. And with advanced money movement capabilities, they’re helping customers streamline and scale their operations while supporting meaningful volume for the bank. By introducing international payment services, Mercantile won new commercial business and drove a 130% increase in foreign exchange volume in just one year.

- 5K+ users engaged in chat support in the first 18 months

- 50% growth in foreign exchange volume in just one year

- 10% asset growth from 2019 to 2024

To compete against larger banks

Mercantile’s ability to compete with large national banks makes their communities stronger. They’re dedicated to living, working, and volunteering in the communities they serve. And when you pair their local involvement with the same digital capabilities of the mega-banks, you get top-notch experiences and deep relationships that build financial strength. Q2’s fintech partner ecosystem has been a big differentiator on this front—helping Mercantile deploy competitive solutions quickly and cost-effectively.

Q2 is not a vendor to us. They are very much a strategic partner. And one that we rely on 24 hours a day, every day of the year.

President & CEO

Tools for success

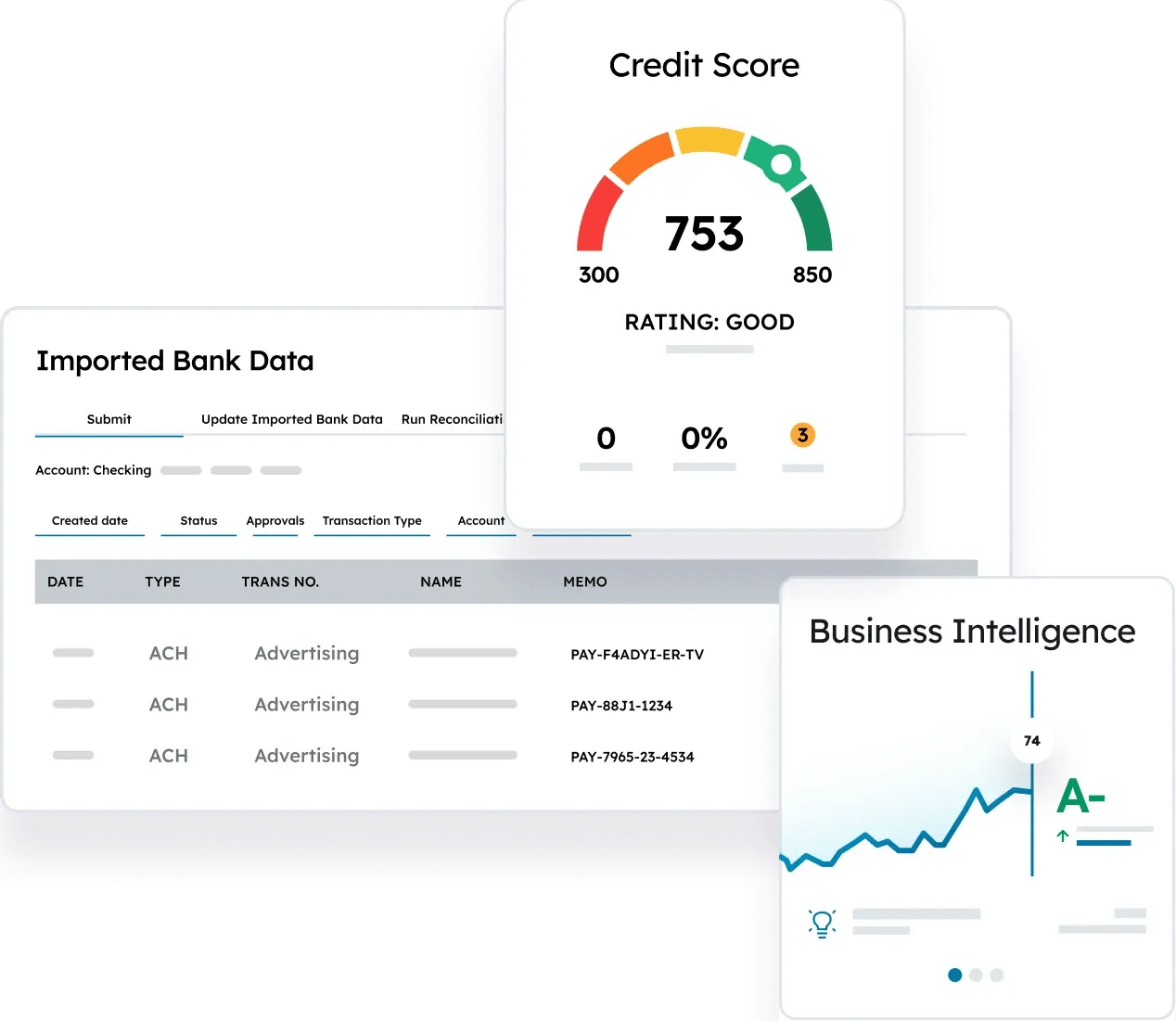

As Mercantile Bank works to keep customers at the center of everything they do, Q2 helps with solutions like:

Q2 Innovation Studio

Mercantile leverages Q2’s robust fintech partner ecosystem to integrate both consumer and commercial solutions—including SavvyMoney for credit score monitoring, Agent IQ for customer support, and PayRecs for international payment services.

Q2 Direct Payables

Mercantile automates the delivery and receipt of ACH and wire payments with Q2 Direct Payables—helping their business customers save several hours per day on file entry.

Q2 Catalyst

For an end-to-end approach to winning and serving commercial customers, Mercantile uses Q2 Catalyst—a suite of commercial banking solutions that helps them scale their offerings and deepen their relationships.