Vera Bank banks on Q2.

- 25 years of service

- $0.5B+ in assets

Supporting the biggest brands in financial services

Founded in 1999, nbkc bank is a rare example of a bank born in the digital era. They got their start as a cross-country mortgage lender, so they learned early on how to operate at a national scale—and without depending on brick-and-mortar branches. It’s no wonder that today, nbkc is one of the most technologically progressive banks in the country. They employ a team of in-house developers dedicated to the digital channels where they do most of their business, and they’re often early adopters of new technology. As they celebrate their 25th anniversary, they’ve grown to $1.2 billion in assets with customers across the United States. And they’ve taken some bold, unconventional paths to get there.

nbkc bank, Member FDIC

Why nbkc banks on Q2

To deliver leading-edge digital experiences

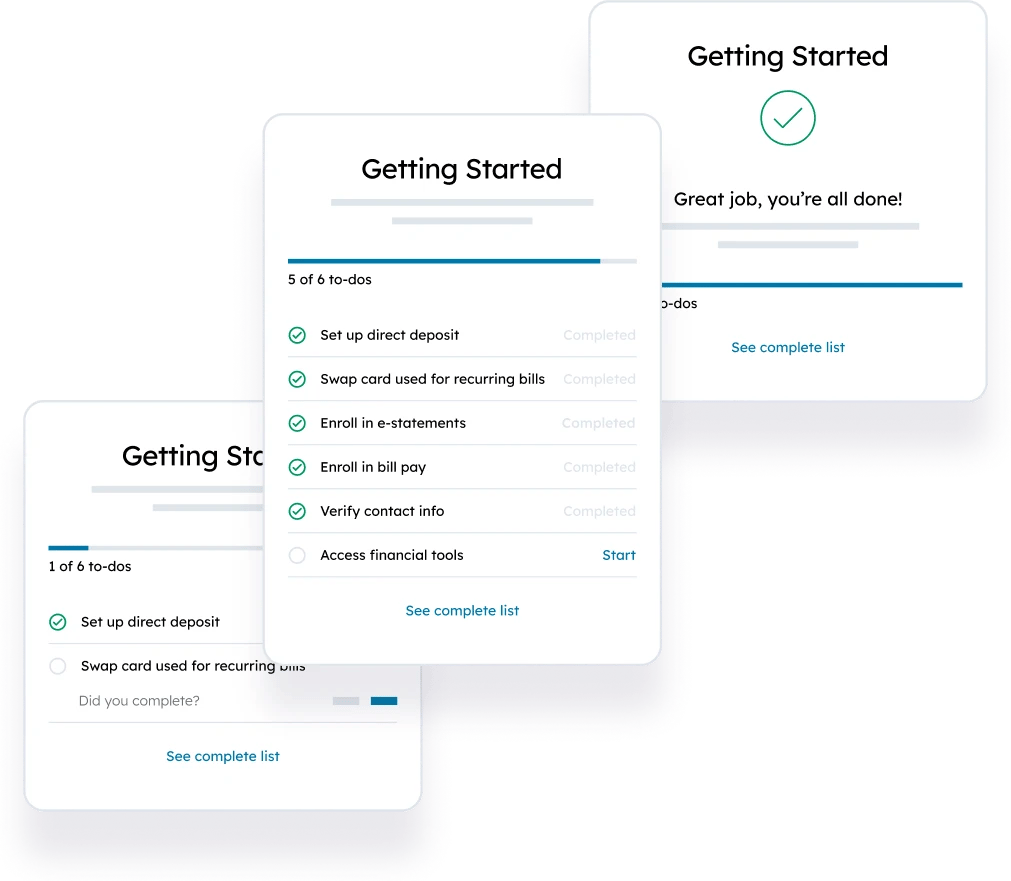

nbkc bank is known across the industry for their premier digital banking experience—one that’s earned them superior app store ratings and a successful digital-only branch that continues to see rapid growth and engagement. Most recently, nbkc set out to enhance their account activation process by beta testing Q2 Getting Started—a tool that guides new customers through onboarding steps to create active, primary relationships from the start. With positive feedback from customers and staff—and the results to prove it—nbkc’s early adoption of Getting Started is just another example of their dedication to delivering top-notch experiences at every turn.

- 15% of Getting Started users linked external accounts to nbkc

- 10% of Getting Started users enrolled in security alerts

- 2.1 out of 5 average customer rating

- 4 physical branches

To drive millions in low-cost deposits

When fintechs stepped onto the scene, many community banks saw a threat. But nbkc saw an opportunity. Judging that banks would be the gateway for fintechs to enter conventional banking, nbkc became one of Q2’s first “banks of record,” partnering with some of the biggest fintechs and brands in financial services to provide them the infrastructure and expertise required to offer banking products—a move that’s generated millions in low-cost deposits for the bank ever since.

To fuel a powerful BaaS program

Today, nbkc's Banking-as-a-Service program is thriving. And they use Q2’s Helix platform as the cloud-based core that makes it happen. For nbkc, this program is more than a steady source of deposits. Working hand-in-hand with financial services’ most innovative companies fuels the creative spirit that keeps them ahead of the curve—and in the process, they’re improving the availability of financial products for millions of Americans.

Tools for success

Given nbkc bank's digital DNA, innovative technology is crucial to their strategy. Here are just a few of the Q2 products and solutions they bank on.

Helix by Q2

Q2’s modern, cloud-based Helix core is the platform that powers nbkc’s successful BaaS program—enabling them to help non-bank brands embed banking products into their offerings, like debit cards and checking and savings accounts.

Q2 Getting Started

The Getting Started onboarding widget helps new customers quickly sync their banking needs with nbkc—such as setting up direct deposit and security alerts, creating savings goals, linking accounts, inputting bill-payer data, and more.